Kathleen M. Rehl, Ph.D., CFP®, CeFT® Emeritus

“I’m going to jail, Mom! But I didn’t do it.”

My biracial son’s frantic phone call from a police station over 1,000 miles away made me tear into mama bear mode. With the help of effective, expensive legal and professional counsel, charges against him were dismissed. (Go here to read a poem I wrote after this incident.)

That event shocked me into reviewing my estate plan. Although I previously made moderate modifications, I hadn’t taken major steps to protect and provide for my son in a better way when I pass on.

I’m sharing my personal story with you now because you may also want to consider ways to help your heirs while also supporting your values. Please know that my story is real—not a fictional hypothetical case.

I Changed My Mind

Years ago, I named my adult son as the outright beneficiary of my traditional IRA (Individual Retirement Account). Seemed like a good idea before. But not now.

My IRA has grown over my many careers and years until I stopped working for pay at age 72. Then I merged my various retirement savings accounts into one traditional IRA (not including my ROTH IRA and an inherited IRA). I always lived economically, spending less than I earned and saving a lot. That made my IRA grow over four decades, along with a rising stock market. Today my living expenses are covered by Social Security, a small pension, and other investments. I’ll never deplete my traditional IRA balance, because I mostly reinvest my required minimum distributions. With a balance of over $1 million, my IRA is the largest asset I own. Continuing to grow tax-deferred, it’s a taxable ticking time bomb for my son as the beneficiary. He’ll owe ordinary income tax on every dollar he withdraws from my account someday. Ouch!

Like Winning the Lottery

When my son inherits this IRA, his spending might increase dramatically. That happened before when he received his late father’s retirement account. Others convinced him to withdraw all that money and invest this for their best interest. Not good for my son.

Another point. My son has had great professional positions and periods of unemployment or short-term contract jobs. I believe that he has limited retirement savings now after spending down savings when he was out of work. He recently started a good job; however, he has fewer years ahead to save for retirement.

My son will inherit some money from me outright when I pass. But I also want to give him ongoing income in a tax-friendly way—sort of like a private pension. He and my elder law attorney agree that this protection will be best for him.

Death of the “Stretch IRA”

As you may know, many of us with IRAs were rattled by the 2019 SECURE Act. That law mandated that most IRA inheritors in 2020 and beyond (not including a spouse or children under age 18) must withdraw all money in that account within 10 years. YIKES! Previously our IRA beneficiaries could stretch out withdrawals over their lifetime. (Because I inherited my mother’s IRA years ago, I can keep on stretching those withdrawals.)

After I pass, my son must remove and pay taxes on all the money in my IRA within 10 years. That will put him in a higher income tax bracket—a big tax bite if he must withdraw lots of money sooner. Oops!

A Trust That Gives My Son Ongoing Income

I’m creating a testamentary charitable remainder unitrust (T-CRUT) that will pay my son about $60,000 annually for 20 years. If he dies prematurely, that income will continue for my grandson. One million dollars from my IRA will transfer tax-free to fund my trust when I die. Money in the T-CRUT will grow and compound, paying no tax. My son will owe tax only on the income he receives every year—6% of the trust principal.

I Want to Make an Impact and Leave a Legacy

Money remaining in my CRUT after 20 years will transfer to a national nonprofit, for an endowment to benefit a cause dear to my heart—promoting racial justice. This is a win-win arrangement. First, my son or grandson will enjoy 20 years of income. Then, the remainder goes to benefit my designated nonprofit. It almost sounds too good to be true, but with this tax-friendly T-CRUT plan, my son may inherit more money than if he received my IRA outright. PLUS, my designated nonprofit will also receive a major gift.

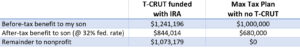

The table below is a snapshot summary of these benefits.

For more details, go here to view a table created using Crescendo planned giving software. Discuss your ideas with a well-informed attorney and tax expert to see what the numbers might look like for your situation. While a T-CRUT may result in more income over a longer period for your heirs, you need to be charitably inclined for a T-CRUT to make sense.

Interested? Below are Pros and Cons:

T-CRUT Advantages:

T-CRUT Disadvantages:

Consider a T-CGA Alternative

Want another plan that also is appropriate for many? Perhaps a testamentary charitable gift annuity (T-CGA) can be a good choice for you. Funded after your death, this gives lifetime income to your heirs, assuming they will be age 65 or older when payments begin. A T-CGA can work well for smaller funding levels and usually requires only a one-page contract with your favored nonprofit.

It is said that we are happiest when our lives have meaning—when we can have a positive impact. For me, that includes expressing gratitude for the many blessings I’ve received during my lifetime.

One way I can actively demonstrate my appreciation is through my T-CRUT gift. That will keep on giving forever . . as part of my lasting legacy.

Kathleen M. Rehl, Ph.D., CFP®, CeFT® Emeritus wrote the award-winning book, Moving Forward on Your Own: A Financial Guidebook for Widows. She owned Rehl Financial Advisors for 18 years before pivoting to a six-year encore career empowering widows. Now happily “reFired” in her mid-70s, Kathleen writes legacy prose, poetry, and letters . . . plus is an ambassador for several nonprofits. Her work has been featured in the New York Times, Wall Street Journal, Kiplinger’s, CNBC, USA Today, and many other publications. Her website is https://kathleenrehl.com.